Top income earners carry an increasingly heavy tax burden

John Kehoe

The rising ‘‘tax concentration’’ on a small number of high-income earners has imposed ‘‘pressures’’ on the personal income tax system, including tax planning by the wealthy which risked eroding community trust, new federal Treasury research finds.

High income earners have shouldered a rising tax burden during the two decades through to 2016, distorting their decisions to save, work and invest, Treasury said.

Following an election fought over the Morrison government’s income tax cuts and Labor’s claims about economic inequality, the Treasury concluded Australia’s personal income tax system became more progressive between 1994-95 and 2015-16.

‘‘Choices by successive Australian governments have altered marginal personal income tax rates and extended tax thresholds in ways that have reduced the income tax incidence on lower income earners, and increased the income tax incidence on higher income earners,’’ the Treasury researchers said.

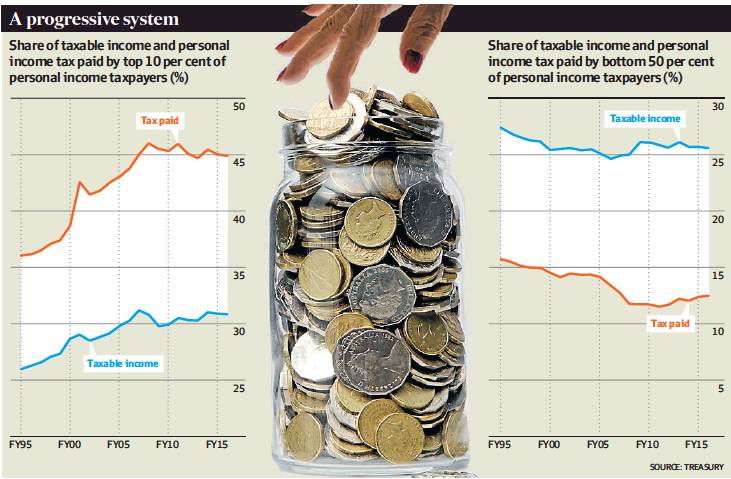

‘‘This has also seen an increase in income tax concentration, whereby a narrower proportion of high income earners pay a larger share of total Australian personal income taxes.’’

The analysis excludes the Coalition’s recently enacted seven-year income tax cut plan, which will give a larger share of the $300 billion of income tax cuts over a decade to higher income earners by 2024-25. Treasury noted taxable incomes have more than doubled for all income decile groups, with the greatest gains experienced by the top 10 per cent, where taxable incomes have tripled over the two decades.

The slowest taxable income gains have been experienced by middle income earners in the 40th to 70th percentile of income earners, with an income range between about $42,000 and $77,000 in 2015-16.

Treasury said there were trade-offs between progressivity in the tax system and efficiency, simplicity and sustainability. ‘‘Escalating marginal effective tax rates can distort individual decisions to work, save and invest,’’ noted Treasury co-authors Graeme Davis, Philip Akroyd, David Pearl and Tristram Sainsbury. ‘‘In general, systems that are more steeply progressive – that is, with higher marginal tax rates and a greater distance between marginal and average tax rate curves – will generate greater inefficiencies.’’

It also said more progressivity in the tax system applying to different forms of income could lead to greater complexity and create incentives to engage in tax planning.

The paper used ‘‘taxable income’’, which includes taxes on salary and wages, net capital gains, interest, dividends, royalties and rental income.

However, taxable income excludes some tax-free incomes such as superannuation earnings for people over 60.

The Treasury paper drew on the Labor government’s 2010 Henry tax review. ‘‘Though progressivity in the system is important, it is necessary that the tax system remains simple and consistent,’’ the review led by then-Treasury secretary Ken Henry noted in 2010.

‘‘Having too many policies aimed at increasing progressivity can make the tax system complex and provide opportunities for tax planning.’’

The Treasury economists note flatter marginal tax rates proposed by the Henry review still led to high income earners paying significantly more tax.