Bets are on for striking oil in Alaska

Australian investors could soon be in line for some good news from faraway Alaska, where an ASXlisted junior oil and gas explorer is set for a drilling campaign in one of North America’s most highquality oil and gas regions.

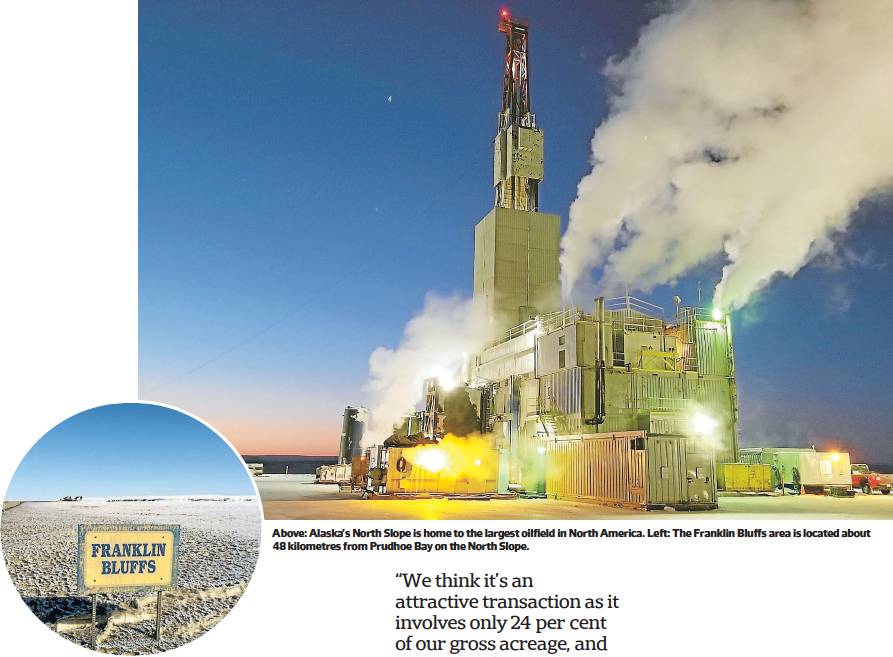

Perth’s 88 Energy plans to drill its first internally generated target via the Charlie 1 well in Alaska’s prolific North Slope region, where it has an interest in close to 500,000 acres with access to the Trans-Alaska pipeline.

It recently signed a farm-out agreement with Premier Oil Plc to fund the entire $US23 million needed for the appraisal drilling, giving the United Kingdom-based exploration and production company a 60 per cent stake in the western area of the acreage, where Charlie 1 is located.

Another 10 per cent interest is held by USbased Burgundy Xploration LLC.

‘‘We thought it was time to de-risk the funding for the project via an industry deal,’’ says 88 Energy’s managing director David Wall.

‘‘We think it’s an attractive transaction as it involves only 24 per cent of our gross acreage, and is restricted to the conventional potential.’’

Alaska’s North Slope is home to the largest oilfield in North America – Prudhoe Bay, which holds in place around 25 billion barrels of oil, first discovered in the 1960s.

For decades, it has been the playground of cash-rich oil and gas majors because of its remote location and tough conditions that include permafrost. But incentives for smaller and independent companies sparked a renewed exploration interest in the early 2000s attracting the likes of Armstrong, ENI and Repsol, who are now among oil and gas companies with projects in the region.

Australian energy major Oil Search also holds assets in the North Slope region, after acquiring the Nanushuk field and allied discoveries from Armstrong Energy in February 2018. It has subsequently agreed to double its stake in the area.

88 Energy itself has been in the region for five years now, conducting petrophysical analysis and modern 3D seismic studies.

The Charlie-1 appraisal well has been designed as a step-out appraisal of a well first drilled in 1991 by BP called Malguk-1. Charlie 1 will intersect seven stacked prospects totalling 1.6 billion barrels of oil.

The Australian company’s share of this prospective resource would be 480 million barrels and it will be free carried on the drilling following the farm-out deal with Premier Oil.

If the appraisal drilling in February 2020 followed by flow testing in April 2020 is successful, the partners expect to come back the following year to drill a horizontal sidetrack of the vertical well. This would be followed by environmental approvals in the lead up to development. Wall is hoping the partners achieve first production in 2024 or 2025. While the value of resource would depend on a lot of factors, Wall estimates that even 70 to 100 million barrels would make a commercial-sized discovery if oil prices stay around current levels of $US55-60 a barrel. The partners are, however, targeting well over 1 billion barrels just from a single well. 88 Energy also holds smaller existing discoveries at the nearby Yukon Gold oil field, where resource prospects are estimated around 90 million barrels of oil. 88 Energy is also hoping to develop its shale asset on the North Slope, which is an unconventional liquids-rich shale play in a prolific source rock, the HRZ shale. The company has so far drilled two wells and is gathering data and trying to find the right characteristics. Results are encouraging, but there’s still more work to be done, Wall says.

‘‘Charlie 1 will test that [shale] play as well and if it has good results it will help us farm out that project also,’’ he says.

While 88 Energy has raised capital from the market on a number of occasions during the last five years to fund its leasing and studies at the acreage in Alaska, it last raised $A6.75 million in September through a share issue.

This will help the company manage the balance sheet in case there are unexpected cost overruns with drilling at Charlie 1, says Wall, who has previous experience both at Woodside Petroleum and as an oil and gas analyst at brokerage firm Hartleys.

88 Energy now holds about $A10 million in cash, providing it with adequate buffer.

Despite the company’s lack of success with the drill bit in Alaska, Wall remains gung-ho about growth prospects for 88 Energy and is hoping Charlie 1 will provide shareholders with the big reward opportunity they have long been waiting for.

‘‘It’s basically Charlie 1, then there is the unconventional project, then we have the Yukon leases,’’ he says.

‘‘These are the three main prongs of our growth portfolio.

‘‘Charlie 1 is the very imminent term growth play.

‘‘We also plan to partner on the Yukon leases within the next 12 months.’’