Crowd-sourced funding at mining’s frontier

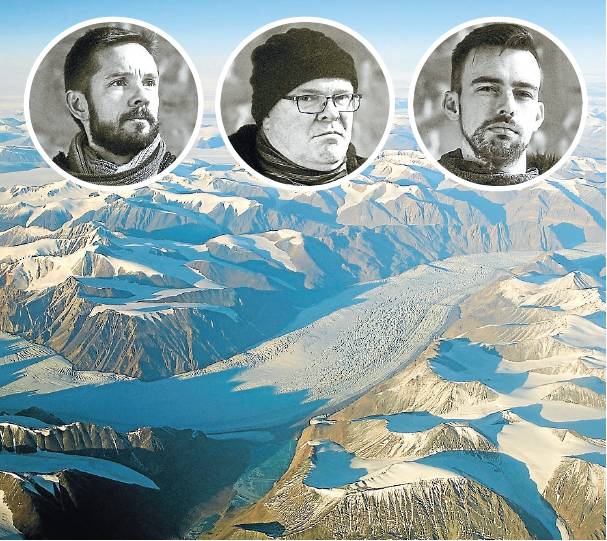

In 2016, geologist and mineral economist Jon Bell began looking to Greenland as a source of mineral resources. He soon realised the Danish administrative division north-east of Canada ticked all his boxes as fertile greenfield territory.

The former Viking settlement had worldclass deposits in zinc, rare earth and mineral sands, yet was ‘‘grossly under-explored’’ for other minerals.

‘‘I thought, ‘Right, it has mineral potential, regulations are simple and they’re in English, the taxes are low and the government is pro-mining’,’’ he says.

Enter veteran mining executive Mathew Longworth as chairperson, along with Lindsay Dick, a 28-year-old corporate lawyer with a background in alternative financing, and Greenfields Exploration was born.

The Perth-based team has now launched what may well be Australia’s first frontier exploration equity crowdfunding venture.

Billfolda is one of Australia’s first seven licensed equity crowdfunding platforms. With a minimum subscription of just under $1000, subscriptions can be made at billfolda.com.

Greenfields is seeking investment under new crowdfunding legislation and hopes to begin exploring a 12,975-square-kilometre parcel of land in eastern Greenland for copper, cobalt and nickel as early as July.

The company has broken ground by applying a start-up model to an industry that’s notoriously slow to innovate.

‘‘To raise funds traditional exploration companies tend to have to go to areas that are known,’’ Bell says.

‘‘That gives investors comfort, but the problem is those areas are depleting. We need to move into new areas.’’ Greenfields’ incubator model means it will do the exploration, then aim to enter joint ventures with mining operators.

‘‘The type of person that goes to a frontier and explores is by nature an adventurer,’’ Bell says. ‘‘But as a company becomes successful, adventurers become administrators and it loses that sense of adventure and the culture that made it successful.

‘‘We figure it’s better to stay as a specialist company, just explore the frontier then partner with someone else. We hope to eventually have a stake in a processing mine, but we’ll be hands off. ’’

Greenfields is seeking just under $5 million, the maximum allowed under legislation. Funding is expected to close at the end of June, with exploration slated to begin immediately and a view to a future ASX listing. The first step is data collection. Then, Dick says, a global competition will aim to ‘‘turn data into knowledge’’ in a unique form of crowdsourcing.

‘‘We plan to take this data and give it to the industry at large saying, ‘Here’s a substantial prize, you tell us what we’ve got’,’’ he says. ‘‘We’re looking for X marks the spot.’’

So what’s in it for crowdfunding investors? Shares, Dick says.

‘‘At the end of the day, they’re ordinary shares. There are no gimmicks involved, no free hats, just a stake in the company, in its risks and rewards.’’

With their Silicon Valley approach Bell and Dick could well be the hipsters of Australian mining, a description they laugh off. Bell says the company has both skills and experience.

‘‘We do want to be an explorer of the future so having a millennial like Lindsay on the board is quite important. We’ve got a young team but older hands as well to guide the process.’’

Disclaimer: Investors should review the Offer Document and General Risk Warning.