‘Next iron ore mine’ to ride surging price

Iron ore had a bumper year in 2020, easily claiming the title of Australia’s most lucrative export commodity, with more than $100 billion worth of shipments departing the country in the fiscal year.

Those shipments were mostly headed for China, which is now responsible for around 70 per cent of global iron ore imports, producing 1.1 billion tonnes of steel last year, according to Commonwealth Bank of Australia (CBA) analysts.

The surge in demand follows Beijing’s embarking on a massive government fiscal stimulus program in response to the COVID-19 pandemic. The stimulus package included a boost to infrastructure spending, which drove crude steel production to a record high of 3.05 million tonnes per day in June.

Alongside these increases in demand, shifts in supply have also worked in Australia’s favour. Before COVID-19, Brazil accounted for 20 per cent of China’s intake of the commodity. But Brazil’s ongoing struggles to address COVID-19 have seen production levels drop off.

The result of these trends has been a surge in the price of iron ore, which recently hit nine-year highs of $US176 a tonne. But with the roll out of vaccines and uncertainty over the longevity of China’s stimulus program, it remains to be seen whether this unexpected boon for Australian iron ore producers will also be a finite one.

“Iron ore prices continue to be supported by strong Chinese demand, although there is still uncertainty around how long Chinese stimulus will persist and whether Brazil can recover to previous production levels in the near term,” noted Treasury’s mid-year economic and fiscal outlook (MYEFO) in December.

Around the same time, CBA analysts reported: “We still think that iron ore prices still have a good chance of averaging $US90 per tonne by Q4 2021, despite near term prices likely to stay high in the short term.”

While ongoing trade tensions between China and Australia have drawn headlines and created uncertainty for everything from beef to coal, industry figures say there is good reason to predict that in the short term, iron ore will remain unaffected by the instability.

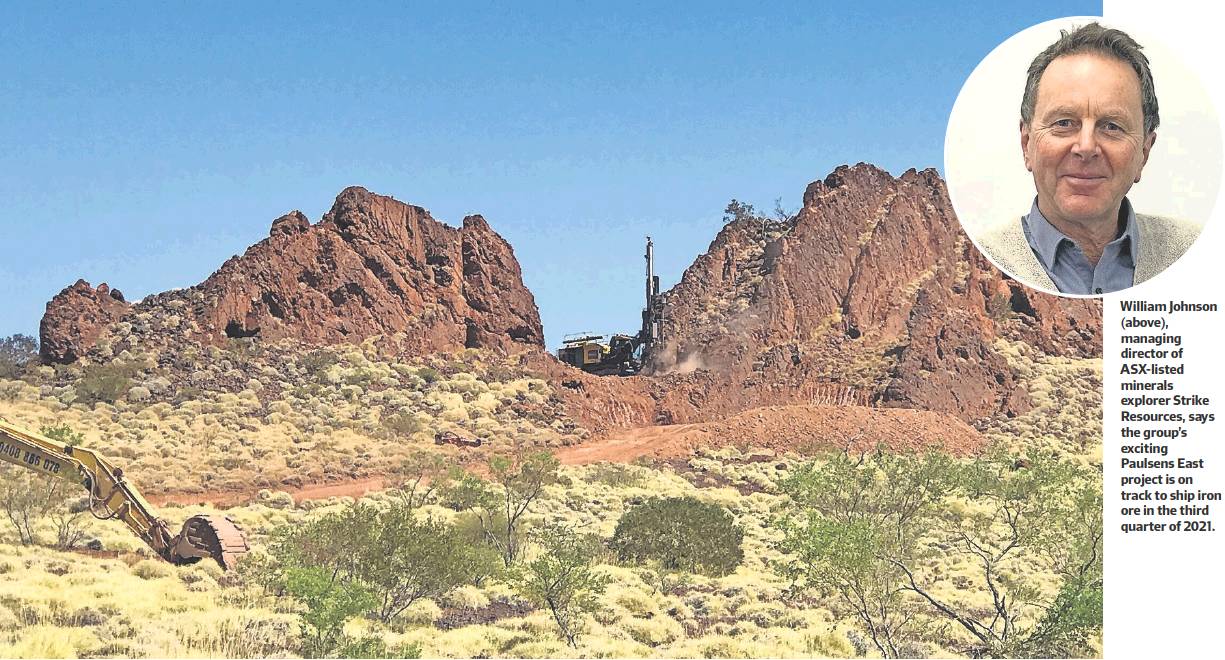

“Iron ore is critical to China, whereas Australian wine isn’t,” says William Johnson, managing director of ASX-listed mineral exploration company Strike Resources. “As Australia is China’s largest supplier of iron ore, it would really be counterproductive for them to impose tariffs or restrictions on Australian iron ore exports.”

Strike’s flagship project is the Paulsens East iron ore project – “Australia’s next iron ore mine” – in the Pilbara region of Western Australia, located 140 kilometres west of Tom Price. The project has an indicated mineral resource of 9.6 million tonnes of high-grade, 61-per cent iron.

A key feature of the resource is a 3 kilometrelong ridge of exposed, high-grade premium iron ore which extends up to 60 metres above the surrounding terrain. It is estimated that the outcropping portion contains approximately 3 million tonnes of high-grade direct shipping ore.

Johnson says the nature of the project makes it ideal for striking while prices remain strong, with planned production of 1.5 million tonnes per year of high-grade direct shipping ore (DSO).

“We’re looking to mine this deposit out within four years, so we’re really working as fast as we can to get into production as quickly as possible, so we can capitalise on this strong price environment.”

Last year, the project reached a number of significant milestones, including the granting of a Native Title Mining Agreement and State Deed approval by the Puutu Kunti Kurrama and Pinikura People (PKKP). The company’s application for a mining permit is currently being assessed by the Western Australian Department of Mines, Industry, Regulation and Safety (DMIRS).

Subject to receiving the necessary approvals, Strike is planning to commence shipments of iron ore in the third quarter of this year.

Alongside the Paulsens East project, Strike Resources has a pipeline of longer-term, largerscale projects as well, including the Solaroz Lithium Brine Project in Argentina (which is adjacent to a project operated by the ASX-listed Orocobre), and the Apurimac Magnetite Iron Ore Project in Peru.

That project is “one of the highest grade, large scale” magnetite deposits in the world, the company says, and has been held by Strike since 2006. The Peruvian government recently commissioned a feasibility study into building a railway in the area – needed to transport iron ore from the mine to port – and Johnson is optimistic about the project’s future.

“This project will essentially open up iron ore deposits and other resources in the region, which have previously been untapped.

‘‘It’s the kind of project that, in my mind, would be very attractive to countries such as China, which have a track record of investing in large scale railway projects and who are clearly interested in securing new supplies of iron ore.”