Hemp, cannabis markets on the cusp of ‘exciting’ expansion

Australia’s cannabis market is expected to reach $US1.55 billion in value by 2025, as growing consumer demand and high-profile international deregulation drive an increasingly favourable global outlook.

The value of the local industry was about $US400 million last year, according to research from consultancy Prohibition Partners. But with changing community views and an increasingly friendly regulation environment, the outlook is expected to improve markedly over the next few years. The report notes Australia has devoted significant resources to domestic cultivation with a view to establishing global supply infrastructure.

“Oceania is fast emerging as a global contender in both the medical cannabis and adult-use space thanks to increasingly liberal attitudes in the region,” said Stephen Murphy, group managing director at Prohibition Partners, in the report. “As the cannabis industry is in its relative infancy, there is a very real opportunity for businesses to set the foundations for a flourishing, considerate, eco-conscious and socially intelligent industry.”

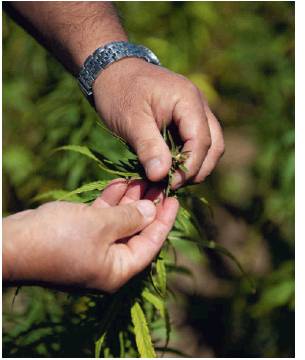

The stigma surrounding cannabis is receding, as awareness grows of the diference between cannabidiol (CBD), which does not have the mind-altering properties popularly associated with marijuana, and tetrahydrocannabinol (THC), which can. Marijuana’s psychoactive properties stem from its relatively high levels of THC– up to 25 per cent. By contrast, industrial hemp has less than 1 per cent THC.

In 2018, the World Health Organisation declared that CBD is “generally well tolerated with a good safety profile” and, by late 2020, the United Nations’ central drug policy-making body had voted to de-schedule cannabis, removing it from a list alongside deadly, addictive opioids including heroin.

Awareness is also growing of the potential environmental benefits of the plant. When cultivated appropriately, hemp is not just carbon neutral but carbon negative.

“It’s the perfect carbon sink,” says Oliver Horn, executive director and global chief executive at Elixinol Global. “Hemp farming requires very low inputs and has very positive efects on soil and biodiversity. And you can use the entire plant, whether for food, clothing, plastics or nutraceutical products.”

The cultivation of cannabis for medical or research-related purposes was legalised in Australia in 2016, although it remains highly regulated. In 2017, certain hemp-based foodstufs were approved as fit for human consumption in Australia and New Zealand. Tasmania leads the country in industrial hemp output, producing about 80 per cent of the nation’s crop on about 1570 hectares.

“Australia has been very conservative when it comes to deregulating hemp,” says Horn. “Cannabis is quickly finding wide acceptance all around the world. The stigma of old is being replaced by people’s understanding of its benefits.”

Elixinol Global was the first industrial hemp company to publicly list on the ASX and has since grown a considerable global footprint. Elixinol’s branded hemp-derived nutraceutical and skincare products can be found throughout Europe and Britain, and the company has a large operation in the US state of Colorado.

The company recently announced the proposed acquisition of Germany’s CannaCare Health, which owns Germany’s leading retail CBD brand.

The acquisition means that Frank Otto, a high-profile German media entrepreneur and CannaCare shareholder and vendor, will join the Elixinol board. His father Werner founded the Otto Group, which was once behind the world’s largest mail-order business and has more recently transformed into an e-commerce giant and the German equivalent of Amazon.

“Besides his lifetime passion for all things hemp, Frank also brings huge connections into Europe and access to capital markets,” Horn says. “We are incredibly excited that a man of that calibre is joining us.

“We’ve now signed a binding agreement to acquire the leading brand in Germany, with over 4500 distribution points. This deal makes sense as part of our vision to build a global, hemp-derived consumer products business.”

Europe is the world’s second-largest CBD market after the US, and Germany is the continent’s fastest growing market. It is forecast to grow at a 47 per cent compound annual growth rate from 2020 to 2025, reaching a total market size of $US600million, according to market research from Brightfield Group.

Locally, Elixinol owns the well-known brand Hemp Foods Australia, the largest hemp foods wholesaler, retailer, manufacturer and exporter in the Southern Hemisphere. While Elixinol endured a mixed 2020 – COVID-19 forced restrictions on footfall in US and European retail outlets, where its products are widely distributed – Horn is optimistic about opportunities in both the short and long term.

“With vaccinations rolling out and stimulus spending in the US, I certainly see the economic environment improving dramatically. We just went into skincare, and we’re going to embed ourselves into Germany. There are regulatory and economic tailwinds behind us and we’re on the cusp of something really exciting.”