JB Hi-Fi sales soften after bumper year

Sue Mitchell

JB Hi-Fi’s new chief executive, Terry Smart, is unfazed at the prospect of overseeing weaker sales and profits in his first year back at the helm, saying the 2021 fiscal year was ‘‘extraordinary’’ and its record volumes would not be repeated.

JB Hi-Fi delivered its eighth consecutive year of record profit growth in 2021 as consumers switched from setting up their home offices during the initial phase of the pandemic to keeping themselves entertained and connected during subsequent lockdowns by splashing out on mobile phones, computers, games hardware, TVs, small appliances and music.

However, analysts expect the record-breaking run to come to an end this year as lockdowns affecting more than 14 million people crimp sales at the 302 stores of Australia’s largest consumer electronics and appliances retailer.

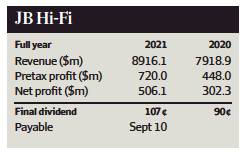

Net profit is forecast to fall to between $388 million and $410 million, after soaring 67.4 per cent to $506.1 million in the 12 months ending June 2021, while sales are expected to dip about 5 per cent.

While rivals such as Wesfarmers’ Officeworks are deemed ‘‘essential’’ and continue to trade, JB Hi-Fi has been forced to close 55 per cent of its stores indefinitely – compared with 5 per cent closed this time last year – until the delta variant outbreak is deemed to be under control.

As a result, same-store sales at JB Hi-Fi stores in Australia fell 15 per cent, while at The Good Guys they fell almost 9 per cent in July and August to date, auguring a softer September quarter.

Mr Smart expects sales of ‘‘high involvement’’ products such as major home appliances and premium consumer electronics to rebound once stores reopen and expects consumers to switch to online shopping for less expensive purchases, but said it would be ‘‘challenging’’ to match volumes in 2021.

‘‘With lockdowns we’ve seen a significant increase in purchases relating to work from home, schooling from home . . . that’s a unique event,’’ Mr Smart told The Australian Financial Review.

‘‘But we know this is a cycle and we have to look through that cycle and just focus on the long-term growth of the business,’’ he said.

‘‘We’re still seeing good solid growth on 2020 figures and . . . we think that will continue for some time to come.’’

Compared with two years ago, JB Hi-Fi’s Australian sales were 19 per cent higher, and The Good Guys’ sales were up 28 per cent on those in July and August 2020.

‘‘Once the vaccination rate increases we feel we will see business open up, we’ll see people start to move around again, and we would anticipate if vaccinations continue at their current rate that will be early next year,’’ Mr Smart said.

Mr Smart did not issue sales or earnings guidance, citing the ongoing uncertainty, but said the group had demonstrated its ability to adapt and was confident about the outlook.

JB Hi-Fi shares rose 2.4 per cent to $49.48, 8¢ off their level a year ago.

The 2021 result was underpinned by fatter gross margins, with strong demand for high-margin appliances and consumer electronics enabling JB Hi-Fi to cut back on discounting and keep costs under control.

Group sales rose 12.6 per cent to $8.92 billion, taking average annual growth over the past five years to 18 per cent. Earnings before interest and tax rose 53.8 per cent to $743.1 million – taking average annual growth over five years to 27 per cent – as gross margins rose 27 basis points to 22.25 per cent and cost of doing business fell 91 basis points to 11.2 per cent of sales.

One of the highlights was the strong growth in online sales, which soared 78.1 per cent to $1.1 billion, or 11.9 per cent of group sales. Unlike many omnichannel retailers, JB Hi-Fi’s online business is as profitable as its bricks-and-mortar business, so there is no margin dilution as online accounts for a larger proportion of sales.

The results were the last for group chief executive Richard Murray, who hands the baton to Mr Smart later this month after resigning in April to take the helm of Premier Investments in October.

Mr Smart was CEO in 2010-14, and was lured out of retirement in 2017 to return to the group as managing director of The Good Guys after it was acquired for $870 million in 2016.

Under Mr Smart, The Good Guys’ earnings have risen almost five-fold, from $46 million in 2017 to $214.7 million in 2021, when earnings jumped 90 per cent after a 14 per cent increase in sales to $2.7 billion.

At JB Hi-Fi Australia, earnings rose 36 per cent to $523 million as sales grew 12 per cent to $5.96 billion, with online sales booming 93 per cent to $780 million, or 13.1 per cent of total sales. New Zealand returned to profit, earning $NZ5.8 million in 2021 after a $NZ22.3 million loss in 2020 due to asset writedowns.

JB Hi-Fi increased its final dividend by almost 19 per cent to $1.07 a share, lifting the full-year payout 52 per cent to $2.87 a share, a payout of 65 per cent of full-year earnings.

However, the group did not announce further capital management measures despite having $263 million in net cash. Finance director Nick Wells said that with 55 per cent of stores closed, a big tax bill and dividend to pay and investment in new stock, JB Hi-Fi wanted to maintain a strong balance sheet.

Mr Smart said stock availability had improved and industry-wide discounting was on the rise, but there were still some shortages in brands such as Apple, Samsung and Microsoft. Further shortages were expected until Christmas and prices were expected to rise.

Jarden Group analyst Ben Gilbert said the result was strong but the negative July-August trading update could lead to share price softness.

‘‘We continue to like JB Hi-Fi but see growing risk as competitive pressure increases, [the] economy reopens, investment steps up and deflation returns,’’ said Mr Gilbert, who has an underweight rating on the stock.

Citigroup analyst James Wang said the trading update suggested momentum had accelerated on a two-year basis, and ‘‘remained resilient despite store closures’’.