Market bets Westpac won’t hit cost target

James Eyers

Westpac’s ambitious plan to slash its annual operating costs from a bloated $13.3 billion to $8 billion in just three years – which has been greeted with deep scepticism by the market – depends on the successful reversal of a huge blowout in ‘‘one-off’’ remediation, compliance and restructuring costs.

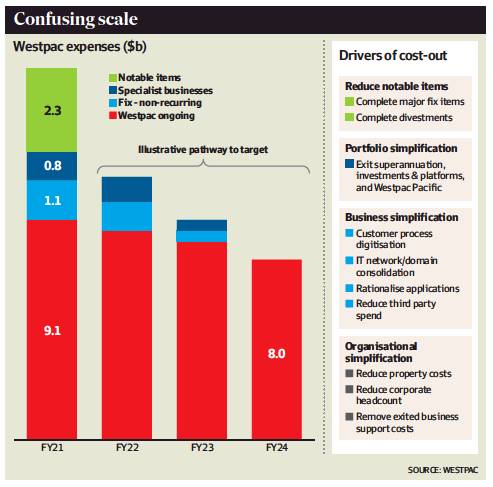

The costs that Westpac identified as one-offs include $2.3 billion of ‘‘notable’’ items, $800 million of ‘‘portfolio simplification’’ costs – relating to the exit of its superannuation and platforms businesses – and $1.1 billion of ‘‘business simplification’’ costs, relating to digitising and rationalising its range of products.

The ‘‘notable’’ items relate to selling insurance and Asian assets to simplify the bank, fixing its compliance systems, and compensating customers after the Hayne royal commission. They also include customer remediation costs, which exceeded $1 billion in the past year, regulatory penalties and write-downs of intangible assets such as goodwill in its institutional bank, which lends to large corporates.

For example, Westpac had to bring on more than 3000 new staff over the past year to help with setting up new financial crime and complaints handling procedures and to meet other regulatory obligations following a run-in with the anti-money laundering watchdog and inquiries into its risk management.

The one-off costs totalled an eye-popping $4.2 billion in the past year. Westpac is betting they can be successfully eliminated by 2024, despite the need to invest in technology to stay competitive and resolve risk management problems, including in the life insurance business it sold in August.

That leaves an ‘‘ongoing’’ cost base with a starting point of $9.1 billion for the year to September 30, 2021, making the challenge of reducing the cost base to $8 billion by 2024 seem that much less daunting.

‘‘The pathway to $8 billion is clear. Every executive and general manager has a three-year plan and an annual target and delivery is in their scorecards,’’ said chief financial officer Michael Rowland on Monday.

The $1.1 billion in ‘‘Fix’’ project costs relates to ‘‘the temporary expansion of our workforce to improve our risk and compliance environment to respond to historical issues and these costs will phase out over the next two years’’, he said.

The problem for Westpac and its executives is that its ongoing costs had increased in 2021 by 7.5 per cent even before the one-offs, and analysts and investors called their bluff and dumped the stock.

The bank’s market value has fallen by nearly $10 billion in the two days since it announced its results on Monday morning.

An unusually frosty exchange during Westpac’s earnings call on Monday showed the depth of scepticism in the market about the bank’s plans for reducing costs and boosting profits over the next two to three years.

Despite the surge in expenses to $13.3 billion for the full-year, Westpac CEO Peter King and Mr Rowland stuck doggedly to their $8 billion cost target by 2024, which was first suggested six months ago.

‘‘We remain committed to that target and expenses in 2022 are expected to be lower,’’ Mr Rowland assured analysts, pointing to extra risk and compliance costs this year that won’t need to be repeated, and efforts to digitise mortgages that should reduce the cost of delivering them to customers.

But analysts weren’t buying it. In a tense briefing, which began at the same time the bank’s stock was nosediving on Monday, Morgan Stanley’s Richard Wiles said the higher underlying costs in the past year didn’t ‘‘give us much comfort’’ in management’s ability to reduce them this year.

He highlighted confusion within the 131-page slide deck. One slide presented a ‘‘Clear path to $8bn cost target’’. There was no vertical axis, but it showed the $13.3 billion of expenses in 2021 and three additional bars tracking to the $8 billion target in 2024.

Analysts read this as costs being just over $10 billion next year, and $9 billion in 2023.

To confuse matters further, Westpac said the slide provided an ‘‘illustrative pathway’’ to taking costs out rather than any cost guidance. ‘‘We are not going to disclose what we see as the cost base for next year,’’ Mr Rowland said.

Mr Wiles was flummoxed. ‘‘Should we ignore that drawing? Is that drawing to scale? Is that illustrative? Or is it guidance?’’ he asked.

‘‘What we are saying is that shows you the trajectory of how we are looking at it,’’ said Mr Rowland.

‘‘That is the best way to look at it ... it is more likely to come off in a trajectory sense in 2022 and 2023 ,but we have given you guidance it will come down in 2022.’’

Jefferies’ head of bank equity analysis Brian Johnson backed Mr Wiles, suggesting the slide was misleading.

‘‘It looks like $10.2 billion to me,’’ Mr Johnson said, ‘‘and I am really confused whether you are saying that is an error in the drawing, or whether that is guidance. I am going to assume the drawing is correct, and I think the whole market will.’’

Yesterday morning, both analysts delivered their verdict on the full-year results and the lack of precision in the briefing, and questioned whether some ‘‘one-off’’ costs might actually re-occur.

Mr Wiles downgraded Westpac yesterday and explained its ‘‘Fix’’ agenda, to repair risk management systems, and its efforts to reinvigorate growth ‘‘are having a larger and more lasting impact on profitability’’.

‘‘We also have less confidence in Westpac’s ability to execute on the key drivers of a turnaround during FY22,’’ he warned clients, lifting Morgan Stanley’s forecast for expenses in 2022 by 5 per cent, but suggesting the market will want to see a ‘‘high single-digit cost reduction’’.

‘‘Management is guiding to ‘lower’ costs in FY22, but there is a lack of clarity on the level of ‘non-recurring’ expenses associated with the ‘fix’ agenda, the outlook for the core business, and the stranded costs relating to the specialist businesses,’’ Mr Wiles said.

Mr Johnson also expressed deep concerns about Westpac’s ability to deliver on cost reductions.

‘‘Such an ambitious cost reset also comes with revenue risks with Westpac net promoter scores languishing,’’ he wrote. ‘‘Execution risk remains the central issue. Retail banking competition is extreme, Westpac is tarnished and Westpac’s historical execution poor.’’

Mr Johnson said the pledged cost reset ‘‘is massive, all the more so given 52 per cent of FY21 costs are staff’’.

Mr Wiles, meanwhile, said Westpac’s ongoing challenges to address issues that accumulated between 2015 and 2020 include ‘‘strategic inertia, weak franchise momentum, an incomplete integration of St George Bank, ineffective cost control, an inadequate risk culture and governance, and sub-optimal capital management’’.