CBA puts banks ahead of tech in crypto race

James Eyers and Jessica Sier

Commonwealth Bank CEO Matt Comyn has put a stake in the ground for mainstream banks rather than tech giants to be the cryptocurrency providers of choice for most customers, saying a proliferation of private coins could threaten the stability of the banking system.

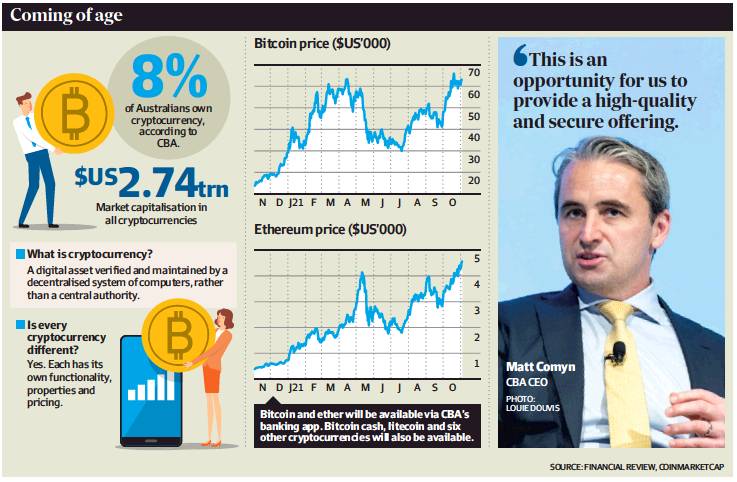

Confirming CBA would bring crypto into the mainstream by letting its customers buy and sell 10 different digital coins inside its banking app, as reported by The Australian Financial Review yesterday, Mr Comyn urged financial regulators and policymakers to grasp the risks to the economy from the rising popularity of cryptocurrencies.

He offered to collaborate with regulators – who have been accused by politicians of falling behind fast-moving developments in cryptocurrencies such as bitcoin – on a regulatory model that ensured large financial institutions could fend off global technology players seeking to play in the monetary system.

Mr Comyn said banks must play a central role in digital asset markets, including educating and protecting consumers. Financial institutions working with central banks should be the ones to safeguard national currencies, not technology companies such as Facebook, which had proposed a digital currency known as Diem, he said.

‘‘Australia should be extremely thoughtful about who should be able to issue currency, and that is part of the broader debate around the future of the financial system in Australia,’’ Mr Comyn said. ‘‘I think Australia would be looking at some of the tech players and their plans to issue their own coins and currencies and be thinking through the implications of that over the long term, on things like monetary policy and the taxation system. It is part of a very important debate, and I know policy-makers are thinking about it.’’

CBA’s surprise move to bring cryptocurrencies such as bitcoin and ethereum into its banking app was met with astonishment yesterday. Industry players said it validated the volatile sector, while also creating new competitive tensions with local exchanges. There were also hopes it would reduce incidents of start-up ‘‘debanking’’ (a loss or limitation of access to banking services), which a recent parliamentary inquiry declared was rife in major banks.

Observers said the validation of bitcoin by Australia’s largest bank would drive more investment into blockchain, the disruptive technology that underpins cryptocurrencies and other digital assets. This could see bitcoin evolve from a store of value or form of digital gold into something that rivalled fiat currencies as a means of exchange for payments and other money-like functions.

CBA yesterday confirmed The Australian Financial Review’s report that it would partner with Gemini, a US-based exchange founded by the Winklevoss twins, and Chainalysis, which works with US law enforcement on compliance and monitoring, to offer crypto investing to more than 6.5 million users of its banking app.

Recalling the history of CBA, which was created to help consolidate the different banknotes offered by Australian banks into a single national currency, Mr Comyn told regulators that innovation was moving so quickly that Australia was in danger of being left behind.

‘‘We want to be part of that innovation; we want to be developing that; we don’t want to be responding and reacting to it after the fact,’’ he said. ‘‘Our position would be: we would like to work very constructively with both the government and regulators and the Reserve Bank.’’

Some local crypto exchanges said CBA’s move would drive volumes across the sector, while others questioned why the country’s largest bank hadn’t partnered with a local player.

BTC Markets CEO Caroline Bowler said: ‘‘Expanding crypto into the mainstream, as this move now pushes through, will shake up the industry in Australia.

‘‘Smaller brokers and exchanges must be looking at their business models today. Larger exchanges such as ourselves see this as an opportunity.

‘‘There is more to crypto than buy, sell and hold, and traditional finance still has a long way to catch up.’’

Adrian Przelozny, CEO of Independent Reserve, which recently secured a licence to operate in Singapore, said it was frustrating to see CBA partner with an exchange based abroad (Gemini is a US company) rather than a local.

‘‘It’s disappointing that CBA went with an overseas player and didn’t engage with local players at all. We will be reaching out to the other Australian banks now,’’ Mr Przelozny said.

Advisers said the CBA embrace of cryptocurrencies, including bitcoin, would ripple through the industry and drive more investment to respond to demands from younger customers.

KPMG fintech global co-head Ian Polari said: ‘‘This announcement from CBA reflects a broader movement by the global banking and payment industry in acknowledging the growing customer interest in and adoption of cryptocurrencies, most notably in specific segments like Millennials, tech-savvy and finance professionals.’’

Several players in the local crypto space hoped the validation by CBA would prompt it to take a more open, considered approach to providing financial services to the sector, after a Senate committee heard in September that debanking was rife across the industry.

Senator Andrew Bragg, who two weeks ago chaired the Senate select committee that proposed a new regulatory regime for the crypto economy, said he welcomed ‘‘the further mainstreaming of cryptocurrency’’ and CBA’s move suggested the inquiry ‘‘was right to identify the utility, agency and employment dividends of crypto’’.

However, he said ongoing scrutiny was required to ensure regulated banks supported innovative start-ups experimenting with decentralised technologies. The final report of his committee called for bank due diligence standards on start-ups to be clarified through the Council of Financial Regulators.

‘‘Perhaps now that the banks have adopted cryptocurrency, they’ll stop debanking Australians,’’ Senator Bragg said. ‘‘The behaviour of banks routinely closing business and personal accounts has unfairly hurt many Australians and the economy at large.’’

In a conference call, Mr Comyn said CBA had no board or other policy in the bank to not bank the crypto sector. ‘‘We do support some crypto providers; we don’t have a policy against it,’’ he said.

‘‘Some of those who would like to be banked by the commercial banking sector will continue not to be, based on their business model and the risk profile. It is a case-by-case [assessment] to understand their business model and be comfortable and satisfied the controls we have in place are sufficient to manage the risk we take on by banking that particular customer.’’

‘‘Over time, the industry matures.’’

Blockchain Australia CEO Steve Vallas said in offering 10 crypto investments to its customers, CBA had provided ‘‘a clear signal that regulatory certainty will be sufficient for this to be able to operate. When combined with Bragg and international developments, it says: there is enough certainty to proceed’’.

He also said other banks would have to examine their strategies or risk bleeding young customers to CBA.

Mr Comyn recognised crypto was a polarising subject in banks, and some of CBA’s competitors hoped ‘‘regulators will regulate the industry out of existence – but our view is that is unlikely’’.

The decision to join up with Gemini and Chainalysis, a compliance specialist that has just opened an office in Canberra whose clients include the US FBI, was a response to customers wanting to invest in crypto safely. CBA was ‘‘a named bank with an institution grade offering where they can have confidence and trust,’’ he said.

‘‘We see both opportunities and risk for the financial sector, so we want to participate in that.

‘‘This is an opportunity for us to provide a high-quality and secure offering. We recognise this is a space broadly defined as being in a bit of regulatory flux globally, and we think it is important to actively support and work constructively with regulators to make sure we are offering a very good proposition to our customers.’’

Gemini global head of business development Dave Abner said the exchange was closely focused on security and held a trust licence in New York. He said standards had improved since the Gemini founders, who were also early investors in Facebook, set up the business in 2014.

‘‘When Cameron and Tyler Winklevoss first got into bitcoin, it was like the Wild West,’’ Mr Abner said. ‘‘They wanted to create a regulated, institutional-class, easy and safe way to trade and store bitcoin and other cryptocurrencies.’’

CBA will tell customers to ‘‘make sure [they] understand the product and are comfortable with the risk’’, Mr Comyn said, even though the bank’s analysis showed most transactions in the space were relatively small, in the hundreds of dollars.

Visa and Mastercard this year announced they were extending their reach into crypto.

Mr Comyn said while CBA would not offer crypto payments immediately, it was possible payment functionality would be added in the future; he said Gemini had a card attached to its offering.

‘‘It is about more than just pure investment,’’ Mr Comyn said. ‘‘There are certainly some customers, small at the moment, who want to live their life in crypto and would prefer to pay [with it]. We see that as an area where there will be continued innovation.’’