Omicron scare threatens to derail recovery

Richard Henderson

Australian shares are set to tumble today as worries about the new omicron COVID-19 variant quickly escalated over the weekend, sapping global equity and commodity markets and triggering a rush to haven assets.

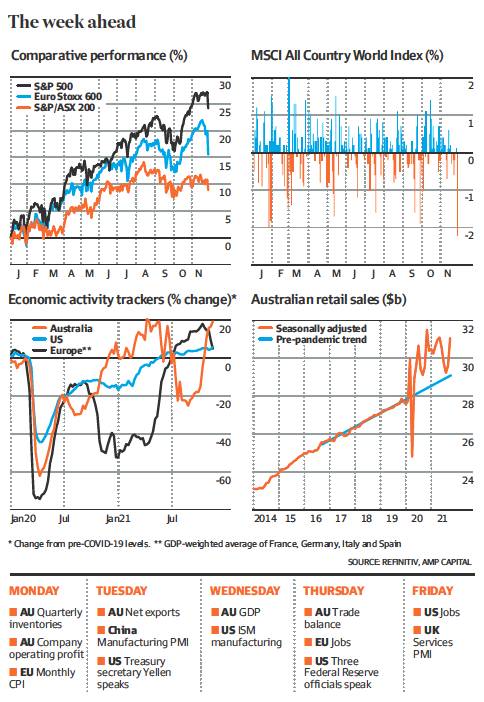

A drop for Australian share futures after markets closed on Friday implies a 1.4 per cent decline for the S&P/ASX 200 index this morning, compounding the blue chip benchmark’s 1.7 per cent fall on Friday.

The projected drop would send Australian shares to the lowest level since the start of June and mark the biggest fall over two consecutive sessions in 18 months.

The decline for Australian share futures indicates investors are bracing for ‘‘further weakness for the Australian sharemarket’’, said Shane Oliver, senior economist at AMP Capital.

The downdraft comes after global equity markets sold off sharply on Friday. The MSCI All Country World Index benchmark dropped 2.2 per cent, its biggest one-day fall since October last year.

The S&P 500 index of US equities plunged 2.3 per cent, while the Euro Stoxx 600 shed 3.7 per cent in a vicious bout of selling that extended across the commodities complex and weighed on the Australian dollar.

The oil price dramatically reversed its ascent over the past few months, wiping $US10 from West Texas Intermediate, the US oil benchmark, which shed 13 per cent to $US68.15 a barrel in one of its biggest one-day declines on record.

Brent crude, the international benchmark, fell 12 per cent to $US72.72.

The fall capped a dizzying week for oil traders after the US announced on Wednesday it would release 50 million barrels of oil to help depress rising prices. The plunge has also cast a shadow over OPEC+ deliberations about increasing production to quell prices following the rally in energy commodities over the past few months, triggered by surging demand and weak supply across Europe and China.

The selling extended to iron ore, which fell 2.4 per cent to $US96.65 a tonne, adding further downward pressure on the commodity, which has edged slowly lower from its high above $US200 a tonne in May.

Copper fell 2.5 per cent, nickel dropped 3.2 per cent and aluminium shed 3.3 per cent.

The Australian dollar fell 1 per cent to US71.23¢, touching the lowest level in a year, while government bond markets rallied as investors sought shelter from the tumult.

The yield on the US 10-year government bond fell by 16 basis points to 1.485 per cent, and its Australian counterpart dropped 12 basis points to 1.665 per cent.

Declines across global markets signalled a ‘‘sell first and ask questions later mentality,’’ said Ryan Detrick, chief market strategist at LPL Financial.

‘‘Investors are selling in front of bad news,’’ he said. ‘‘The economic recovery has been quite impressive and the one thing that could knock it over completely would be a more dangerous variant.’’ The sudden tumble for local shares on Friday jolted the market downward after months of trading sideways since the S&P/ASX 200 touched a high in August on bullish sentiment about the global recovery.

Investors also face the prospect of a poor gross domestic product growth reading when the third-quarter figure is released on Wednesday, which is likely to show a sharp decline in a quarter marked by prolonged lockdowns in Sydney and Melbourne.

Consensus forecasts anticipate a 2.5 per cent quarterly contraction for the economy in the September quarter, although NAB economists predict a 3.8 per cent decline.

‘‘Lockdowns in New South Wales, Victoria and elsewhere significantly curbed consumption and disrupted investment activity,’’ NAB economists said on Friday, although robust data in the past few weeks as restrictions have eased indicate robust growth in the December quarter.

‘‘Higher frequency data suggests a strong rebound in activity is under way.’’

NAB economists have tipped a 3 per cent increase in the fourth quarter.

Nigel Green, chief executive of deVere Group, a financial consultant network, said little was known about whether the omicron variant was more transmissible than others.

He also highlighted the fact the Thanksgiving holiday in the US last week would have depressed trading volumes, making a smaller group of big moves more pronounced.

‘‘The headlines have caused a knee-jerk reaction,’’ he said. ‘‘This wobble is likely to be temporary, with markets remaining bullish for the time being.’’

However, others failed to see any optimism through the rapid sell-off.

‘‘Assuming the worst is probably the safe option for now,’’ said Jeffrey Halley, senior market analyst, Asia Pacific, for OANDA, a currency trading company.

Should the new strain trigger ‘‘the reimposition of mass social restrictions, [it] could truly derail the global recovery’’.

‘‘With the delta wave in mind . . . investors are likely to shoot first and ask questions later,’’ he said.