Big Oil Search investors baulk at $21b merger

Angela Macdonald-Smith

At least two big institutional investors in Oil Search have resolved to vote their shares against the $21 billion merger deal with Santos, with one suggesting the ‘‘No’’ vote at next week’s meeting could get close to derailing the deal.

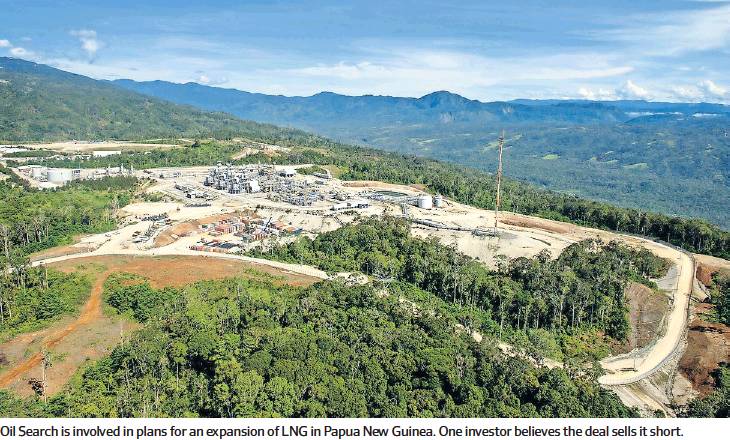

An investor in Asia thought to hold about 2 per cent of Oil Search will vote its holding against the deal, believing the merger ratio sells the Papua New Guinea oil and gas producer short, according to a portfolio manager there who declined to be named.

Allan Gray has followed through with its initial stance and voted the shares it controls against the deal, said portfolio manager Simon Mawhinney. He has previously signalled the firm speaks for more than 4 per cent of the register.

Other Oil Search shareholders that do not also hold shares in Santos are said to be concerned about the value being offered and want the merger terms to be improved, sources said.

However, the dissenting voices are said to be in the minority and the deal is strongly backed by shareholders that own both Oil Search and Santos, meaning that the 75 per cent approval by voting Oil Search shareholders should not be in doubt.

Still, some hold out hope that as participation in shareholder votes typically falls well short of the maximum, at perhaps 65-70 per cent, then the opposing shareholders could have an outside chance of voting it down. The critical proxy votes on the deal that will largely determine the outcome must be submitted by December 2.

Investors’ worries about the value being offered for their stock in the scrip-based deal were heightened by the findings of the independent expert hired by Oil Search to assess the deal that the PNG player is providing significantly more value to the combined company than it is getting paid for.

Grant Samuel calculated that Oil Search is contributing 43-44 per cent of the value of the combined group, but will receive only 38.5 per cent, so shareholders will suffer a loss in the value of their investment. But it still found Oil Search shareholders would likely be better off if the merger proceeds due to funding challenges for the company on a standalone basis.

All four major proxy advisers have also supported the Oil Search board and recommended shareholders vote in favour of the deal, despite clear reservations on value.

Proxy adviser CGI Glass Lewis said that Oil Search shareholders who are critical of the deal ‘‘could certainly point to what appears to have been a hurried pre-signing process and the apparent lack of a broader solicitation effort by the board, as well as the findings from the independent expert’s . . . analysis, to support such a case.’’

However, it said the merger represented ‘‘a compelling strategic alternative’’ for the company and its shareholders and would help ‘‘stabilise’’ it ‘‘at a time when investors may be seriously questioning the credibility of the company’s leadership’’. It said other financial analyses support the merits of the merger ratio.

Glass Lewis referred to the whistle-blower complaints that contributed to the departure of former CEO Keiran Wulff, the recent lawsuit brought by former interim chief financial officer Ayten Saridas against the company, and the ‘‘misleading’’ statements by chairman Rick Lee during an investor call in July discussing Dr Wulff’s departure. Still, one investor said shareholders should not suffer a loss on value due to the governance and management failings at Oil Search, and that the value of its long-life, high-margin gas assets should be the critical factor in determining the ownership ratio split.

They said Santos was taking advantage of Oil Search’s weakened board but absolutely needed the merger to grow its production profile and avoid a likely equity raising and/or dividend cut to fund its own growth projects at Barossa off northern Australia and Dorado in Western Australia. That meant Santos would not walk away if the deal collapsed, rather it would likely improve the merger terms.

Credit Suisse analyst Saul Kavonic said some investors might ‘‘quite understandably’’ harbour misgivings towards Oil Search’s governance of the merger process and the relative value offered by Santos scrip.

‘‘But one may struggle to see how voting down the merger without a plan for governance change will improve the situation, as it could see the company left in the hands of the same board who are responsible for shareholders current discontent.’’

The dissenting shareholders say the board can be strengthened and a new CEO found, and Oil Search’s funding issues essentially resolved by selling its Alaskan oil asset.

Shares in Santos and Oil Search have been trading relative to each other in accordance with the agreed merger ratio, pointing to a broad expectation in the market that the deal will be done.