CSG discovery points to vast potential

This year is one of transformation for newly formed coal seam gas (CSG) explorer TMK Energy as it looks to unlock the potential of its massive coal seam gas project in Mongolia’s coal-rich South Gobi Basin.

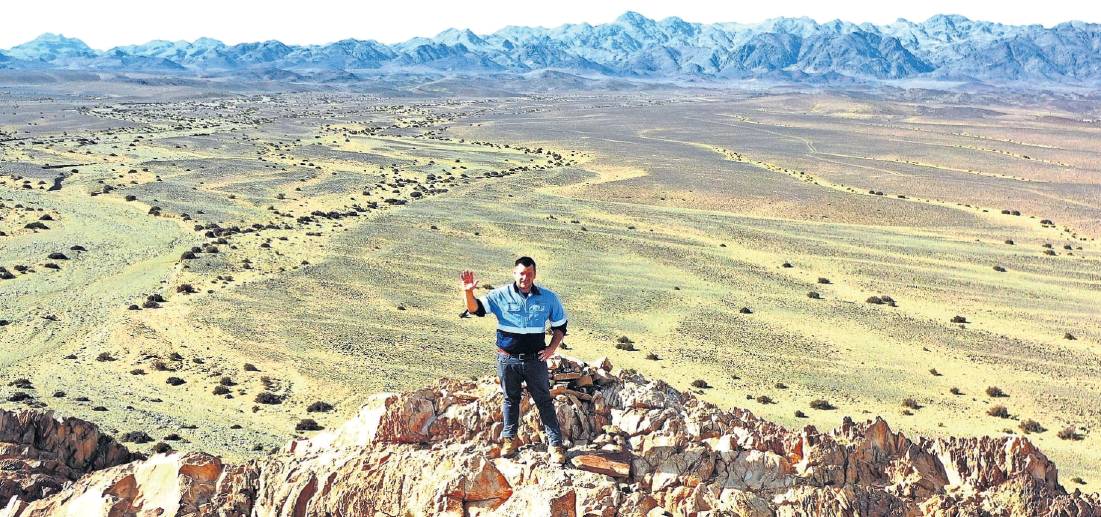

TMK, previously known as Tamaska Oil and Gas, completed the acquisition of the unlisted public company Telmen Energy in February, bringing with it a 100 per cent interest in the Gurvantes XXXV CSG project in the South Gobi Desert, within 40 kilometres of the Chinese border.

Since then, it has been all systems go as TMK has embarked on a four-well drilling program that has, to date, yielded better-than-expected results pointing to strong prospects for a successful large-scale commercial gas project.

TMK chief executive Brendan Stats, an experienced operator in Mongolia who joined the company from Telmen as part of the acquisition, says TMK is one of a pioneering group of companies exploring for large-scale CSG prospects in the country.

Stats says the discovery of very thick coal seams with high gas contents in the first two of its planned four wells is a terrific result, with key technical parameters better than developed CSG projects around the world.

Significantly, the coal deposit’s shallow depths and relatively high permeability mean it should be an easy process to bring gas to the surface.

“The results so far point to a very significant gas resource and drilling of the third well is currently ongoing,” Stats says.

TMK has a prospect of about 8500 square kilometres, though the area under current exploration is only about a quarter of that. Its location close to the Chinese border puts it in a prime position to capitalise on China’s ever-growing demand for energy.

“That’s where the big opportunity lies,” Stats says. “With a project of this scale, we can supply the domestic market in Mongolia, which is important, but also supply significant volumes of energy to the largest energy market located within sight of the project.

“Chinese demand for energy is only likely to increase. Our proximity to the major gas infrastructure just across the border means we should be able to deliver far cheaper gas than most other competitors.”

Compared with some other Chinese import sources, where gas is liquefied for transport and then re-gasified at its destination, Mongolian CSG can be piped directly to the existing Chinese infrastructure at a considerably lower cost.

Mongolia’s capital, Ulaanbaatar, struggles under an ageing, unreliable electricity grid, which relies heavily on coal, while residents burn a variety of high-polluting materials to heat their homes. Stats sees a reliable supply of cleaner-burning gas from projects such as TMK’s as a big benefit for local energy security as well as addressing significant pollution and health impacts associated with current energy sources.

“It’s early days for a coal seam gas industry in Mongolia, but there is huge potential,” he adds.

Stats says the industry in Mongolia is in a similar position to where Queensland was 20 years ago, with large known coal reserves but little investigation into the potential for CSG.

Mongolia has recently updated its petroleum laws to foster an unconventional gas industry and issued the first exploration agreements in 2018.

Stats says that move had been the catalyst for a lot of activity and in 2021 TMK’s acquisition target, Telmen, was one of the first companies to be granted a licence to explore for CSG.

The extensive large-scale coal industry in the South Gobi means there is strong geological data available to guide CSG explorers to the best prospects.

“This groundwork will allow us to move through the process quicker than we could on a greenfields site where we would be starting from scratch,” Stats says. “We can spend less time exploring, more time developing.”

Given the logistical challenges of managing the project from offices in Sydney and Perth, Stats says TMK decided to recruit and train a local workforce to lessen reliance on contractors.

“They work under some supervision and oversight from technical experts from Australia, but the project is run day to day by our Mongolian team, many of whom are shareholders in the company.”

The Telmen acquisition included an existing farm-in agreement with another ASX-listed explorer, Talon Energy. The latter is funding the initial $US1.5 million of exploration costs at Gurvantes, after which it can elect to earn a 33 per cent interest in the project by spending a further $US3.15 million on a proposed pilot well program.

TMK hopes to complete its test wells by the end of July after which it will update the resource estimate for Gurvantes.

“We aim to have a pilot well producing gas by the end of the year as another step towards commercial production,” Stats says. “We want to fast-track it as much as we can.

“It’s been a big year for us so far and we hope it will continue to be – to go from initial exploration with first drilling in March to hopefully flowing gas to the surface by the end of the year.”

While TMK’s immediate focus is driving Gurvantes to its production phase, it also holds a 20 per cent stake in a promising natural gas project closer to home.

The Talisman Deep Project, which contains the Napoleon structure, is an offshore prospect in the Barrow-Dampier sub-basin of north-west Western Australia.