Loan repayments stacked in your favour

We are a nation of small business owners but that doesn’t mean we have to stay small, think small or let big banks treat us like we are small, says Larry Prosser, chief executive of Beyond Merchant Capital.

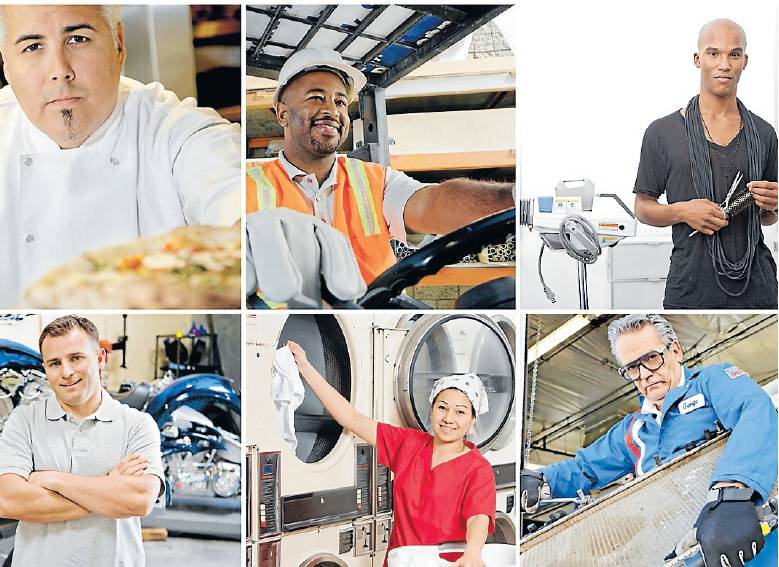

Small and medium-size enterprises (SMEs) kick the economy forward by an estimated $380 billion a year and employ about half of all working-age Australians.

Supportive, affordable access to finance is critical to business survival. However, securing finance can be a brutal experience for merchants and small businesses.

As a fintech focusing on timesensitive, personalised solutions for Australian merchant businesses, Beyond Merchant Capital and First Data have created a pay-as-you-trade model that aligns repayments with turnover.

A merchant cash advance (MCA) ensures a merchant’s payments are always within a manageable, hyperpersonalised context, removing cash flow-related stress, because when business is slow, so are repayments.

The funding, up to $500,000, is quick and in a merchant’s account within 24-48 hours, paid back with super-flexibility and near invisibility through EFTPOS.

Prosser says Beyond Merchant Capital is also able to collect payments via debit order directly from the merchant’s bank account.

‘‘Our mission is pretty simple. We want to help SMEs grow and we use a really unique funding and payment model to provide a working capital injection that is paid off seamlessly through the credit card terminal,’’ says Prosser.

‘‘Each card swipe pays off the advance with an agreed percentage that remains barely noticeable and entirely manageable. We take the risk with the merchant and there is no fixed term, as with other lenders in this space.’’

While fintech lenders such as Beyond Merchant Capital are remapping the Australian lending landscape to make it more SME friendly, Prosser is urging small businesses to avoid loan stacking.

‘‘We have an anti-stacking clause written into our contracts because there are now also highly destructive and high-risk, highinterest lenders out there who reactively promote stacking for their own benefit. It leaves a trail of ruin,’’ he says. The best lenders, including Beyond Merchant, are opposed to these practices and have an antistacking policy.

‘‘The risks to a small business of piggybacking one loan on top of another are huge to merchants and devastating for us, because it’s so hard for us to help if it’s already happening,’’ Prosser says.

Beyond Merchant Capital, the Australian Small Business and Family Enterprise Ombudsman Kate Carnell and FinTech Australia are working on an industry code of conduct that includes pricing conventions and financing tools.

The code is aimed at helping protect consumers and empower small business owners to compare the true costs of borrowing. ‘‘Strong and growing Australian businesses are our life too, and we want our customers to know we are investing in them just as generously as we are lending to them,’’ Prosser says.

The advice in this article is general in nature. Before proceeding, you should seek independent advice.

‘Strong and growing Australian businesses are our life too.’

- Larry Prosser