Super fund slayer sets sights on Commonwealth bonds

Charlotte Grieve, Nick O’Malley

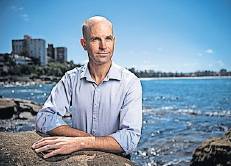

The lawyer who sued $57 billion super fund Rest over its climate change disclosures now has the Australian government in his sights, with a world-first lawsuit over Commonwealth bonds set to begin next week.

Equity Generation Lawyers principal David Barnden acted on behalf of 25-year-old Rest member Mark McVeigh, who sued the super fund for retail workers in a landmark case settled this week. The settlement included a commitment from Rest to publish all portfolio holdings and align its investments with a ‘net zero’ emissions target by 2050.

The climate specialist firm is now suing the federal government over its alleged failure to appropriately disclose climate risk in the bonds it issues on behalf of university student and investor Katta O’Donnell.

Mr Barnden said the Rest outcome ‘‘certainly could’’ put pressure on the government to settle the case but his firm was ‘‘prepared for anything’’.

‘‘We’re in it to win,’’ he said. ‘‘It’s not difficult to imagine that the more debt Australia has, the more sensitive bondholders may become to risks such as climate change.’’

As part of the settlement with Rest, the fund made a public statement on climate risk that Mr Barnden described as a victory.

‘‘Climate change is a material, direct and current financial risk to the superannuation fund across many risk categories, including investment, market, reputational, strategic, governance and thirdparty risks,’’ the super fund said.

‘‘The settlement outcome and what Rest has committed to is a wonderful outcome for our client,’’ Mr Barnden said. ‘‘One would think that the threat of legal action should spur funds to do better.’’

A string of major Australian financial institutions have recently racheted up their commitments to ‘‘transitioning’’ the economy from a reliance on carbon emitting industries to a greener future. Major industry super funds, including healthcare fund Hesta and AwareSuper, have committed to net zero targets and reduced exposure to fossil fuels.

Big four bank ANZ last week also pledged to exit thermal coal by 2030 and stop funding new coal mines and power stations immediately. ANZ chief executive Shayne Elliott said the decision was not made for moral or ethical reasons, rather a calculation of investment risk.

‘‘We’ve seen announcements from some of our biggest coal markets, for example, Japan,’’ Mr Elliott said. ‘‘We can’t just sit and ignore that ... We need to position our business for the future.’’

ANZ’s policy sparked backlash from federal politicians, including Agriculture Minister David Littleproud and Resources Minister Keith Pitt, who said the finance industry should steer clear of activism.

Mr Barnden said the government’s reaction showed it had become ‘‘increasingly isolated’’ in its response to climate change.